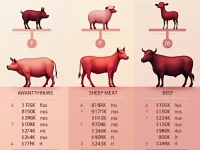

Meat Exporters Face HS Code and Tax Policy Challenges

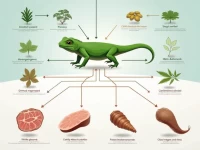

This article provides an in-depth analysis of HS codes and their corresponding rebate policies in meat exports. It emphasizes the importance of accurately understanding this information for meat traders, as it offers dual benefits of profit enhancement and compliance management.